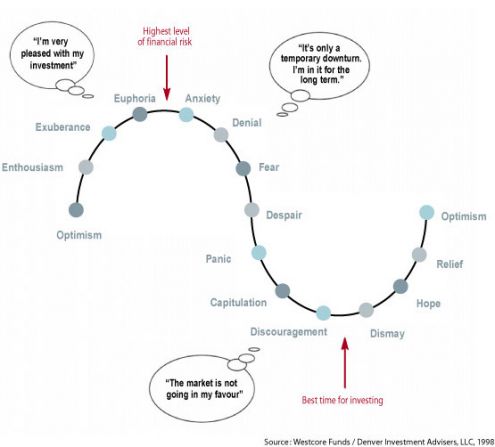

Emotions control our decisions everyday and the greatest leaders and traders learn to harness these emotions and use them to their advantage. As soon as money is involved in a transaction, whether it be the stock market, real estate, art work or antiques; emotions ultimately set the final price. Some investors have greater control over their emotions while other investors are destroyed by their emotional reactions to certain situations and events.

One common trait many novice and advanced investors share, including me, is placing a position in a stock at the wrong time. Years ago, I would study a stock’s chart, the fundamentals, the general market health and everything else that I felt necessary before placing a position behind my beliefs. When things went wrong and I was forced to sell based on my basic stop loss, I would drop the stock from my watch lists and remove it from my memory. This was one of the biggest mistakes that I was making during my earlier years of investing. The greatest investors study their mistakes and learn why they were wrong and have no problem getting back into a stock they just sold if another signal is given. If you don’t learn from your mistakes, you will continue to repeat them and never move to the next level. It is extremely importance to stay focused and emotionally stable when things don’t work out as expected.

I was typically correct with my overall stock analysis but many times I was too early with my entry point. Months later, I would come across the same stock in my screens but it was now up 25%, 50% or more from my initial buy point and stop loss. I was frustrated for selling my stock too soon and was getting tired of using basic CANSLIM sell rules and missing big winners that I sold for an 8% loss.

I knew money could be made on Wall Street using the law of averages to my advantage by employing strong money management skills but I had to become more consistent in my approach and grasp a better understanding of how money management truly worked. I started to practice what I was taught by selling my losers quickly and allowing my stronger stocks to ride their trends. Over time, I was experiencing more losers than winners but my stake was growing because these losers were smaller in size than the winners. The words written by my book mentors were true; Jesse Livermore, Gerald Loeb and William O’Neil were all accurate with their lessons about cutting losses quickly. However, the light bulb didn’t truly shine until I read Trade your Way to Financial Freedom by Van K. Tharp. After reading the book, I became more confident and successful by learning to develop a risk to reward ratio for each trade and by setting detailed position sizing calculations.

More importantly, I learned to keep strong stocks on my radar even if I bought too soon and was forced to sell for a loss. My timing was wrong and my ego was shot because I was wrong, so I typically decided to stay away from that specific stock because it had already taken my cash and my pride. Emotionally, I was burned by the stock even though this was not entirely true. Investing is a game of trial and error. It is okay to buy a stock at the wrong time and sell, only to buy it again because they timing may be better. If you cut the losses small and allow winners to grow, your expectancy will ALWAYS work out, I promise. You must be honest with yourself to allow the averages to work out. You cannot allow a stock to drop past your sell point and you must try to always hold the strongest stocks without selling them during a premature pullback. This all sounds so easy but it is not! If it was so easy, we would all be extremely rich and the stock market would be everyone’s full time job.

It is mentally and emotionally difficult to purchase a stock at a higher price now then it was at an earlier date but it can be the most rewarding strategy. Never look at a chart and toss away a candidate because it has moved up 50% or even doubled in recent months, the real move may just be beginning.

The moral of this article is to make you understand that timing may be your only issue when buying stocks so never throw away a possible superstar because you bought too soon. Keep it on your watch list and be prepared to initiate another position, even if it will cost you an extra point or two. If you buy again and it doesn’t work out; repeat the process as there is always a chance that the stock was not meant to be or your analysis was faulty. In either case, learn what you are doing right and wrong so you can be prepared to use those lessons with the next opportunity.