In part 1, I discussed two examples of how and why volume can show the changing face of supply and demand. When the order of supply and demand is change we will get a change in market direction, sometimes a significant change in trend or otherwise some degree of retracement of the prior move. We will now continue on from that discussion and show larger periods of transition which can lead to quite substantial turning points in the major trends. These can be easy to identify, but do require some patience. If you did not read the prior article it would now be worth reviewing that before going on.

Let’s firstly take a look at AWB Limited.

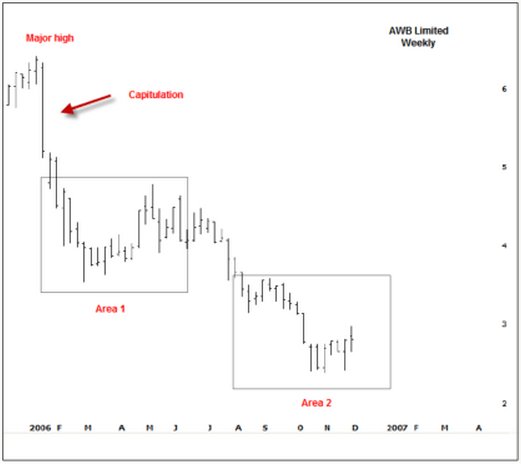

Since early 2006, the price of AWB had been in a downward spiral. The story that eventually came out suggested AWB was doing some bad business against the UN sanction in Iraq. The initial shock sent the shares plunging by 18% in a single week.

This is a sure sign of a change in sentiment and it’s not exactly rocket science to know there must have been some kind of bad news that changes the outlook.

But what is important here is that this significant sell off is actually the first sign that strength may start to appear in the near future. As I discussed in part 1, demand strength actually starts in price weakness and here is a sign of capitulation. A wide ranging bar on increased volume is a sign of panic and when we see panic we can usually expect that a bargain could be in the offering, but this is where the patience is required. What we usually start to see after capitulation is a transition from sellers to buyers. This transition has two important characteristics; firstly it takes some time and secondly prices do tend to drift lower. Let’s zoom into the AWB chart at Area 1 and also add our volume indicators.

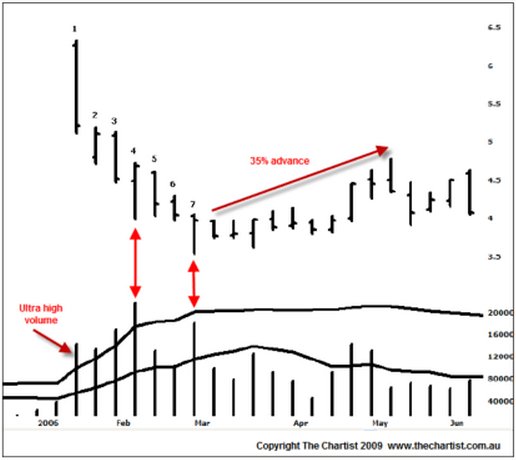

Bar 1 is the capitulation; a very wide ranging bar and ultra high volume. Remember that ultra high volume is signaled when the volume histogram penetrates the volume Bollinger band. Bar 2 gaps lower but closes on the weeks high and does so on high volume. This is a sign that the Smart Money is interested in buying. There is no other way that prices can close higher on increased volume if buyers were not involved. Bar 3 however shows sellers returning; a push lower, a low close and another increase in volume. Bar 4 is the turning point and is a sure sign that buying interest is occurring. This is the time to start thinking that this market will turn higher soon. This bar shows a move to new lows but a complete rejection, i.e. a high close and very high volume. We’re seeing the Smart Money taking positions, even though the stock is drifting lower. Now take a close look at bars 5 and 6. What happens? Essentially they are inside days with a slight downward bias but look at the volume? There is none. Volume has dried right up. This means that sellers are done; they’re exhausted. Those that wanted to sell have either been fulfilled or do not wish to chase prices any lower. Bar 7 sees another probe lower, another high close and yet again a rapid increase in volume. Combined with bars 2 and 4, both of which show background strength, this is continued evidence that the stock is being accumulated. It’s only a matter of time before enough of the supply has been accumulated that prices will start to rise again.

For the next 2 months AWB rallied 34% off that exact low. The first signs of upward price momentum would be the signal to initiate longs. We have the Smart Money footprints in the volume so we just need to time the entry for our own comfort. Take a look at the bars from that low. All down bars had low volume; all up bars had high volume. There was a specific transition from sellers to buyers which led to a reasonable, albeit unsustainable, price rise.

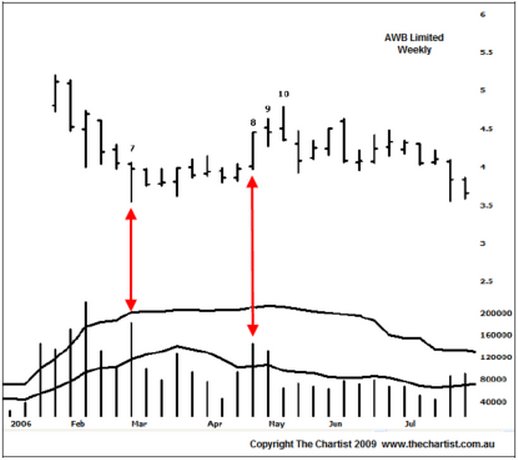

The following chart shows that advance in more detail. Bar 8 was a very promising bar indeed; a wide range higher, a high close and a good increase in volume. With the high close we can deduce that buyers had the control. Bar 9 is an important bar for current longs. It shows an attempted push higher, a reasonably tight range but more importantly a weak close and solid increase in volume. This is the first time that sellers had come back to the market. Now these sellers can originate from two sources; either profit takers that bought at lower levels, after all, it was a rapid rise in quick time which will always create profit taking; or it is very old longs who were waiting for the evitable bounce to get out of their positions. We’re not to know which, but what we do know is that selling has emerged and that caution is required.

Bar 10 shows a rise into new recent highs but a close on the absolute lows. This is of paramount importance – what does it mean? Bar 9 identifies sellers because we had a weak close on high volume. Immediately following, Bar 10 shows a low close on low volume, which suggests buyers have disappeared. If buyers have gone, who is going to support the market if those sellers from Bar 9 decide to chase prices lower? Nobody. If there is no buyer demand or buyer support then prices have the risk of falling until buyer demand comes back again. And that is exactly what has occurred.